The Pakistani Rupee (PKR) tumbled against the US Dollar (USD) and posted big losses during intraday trade today.

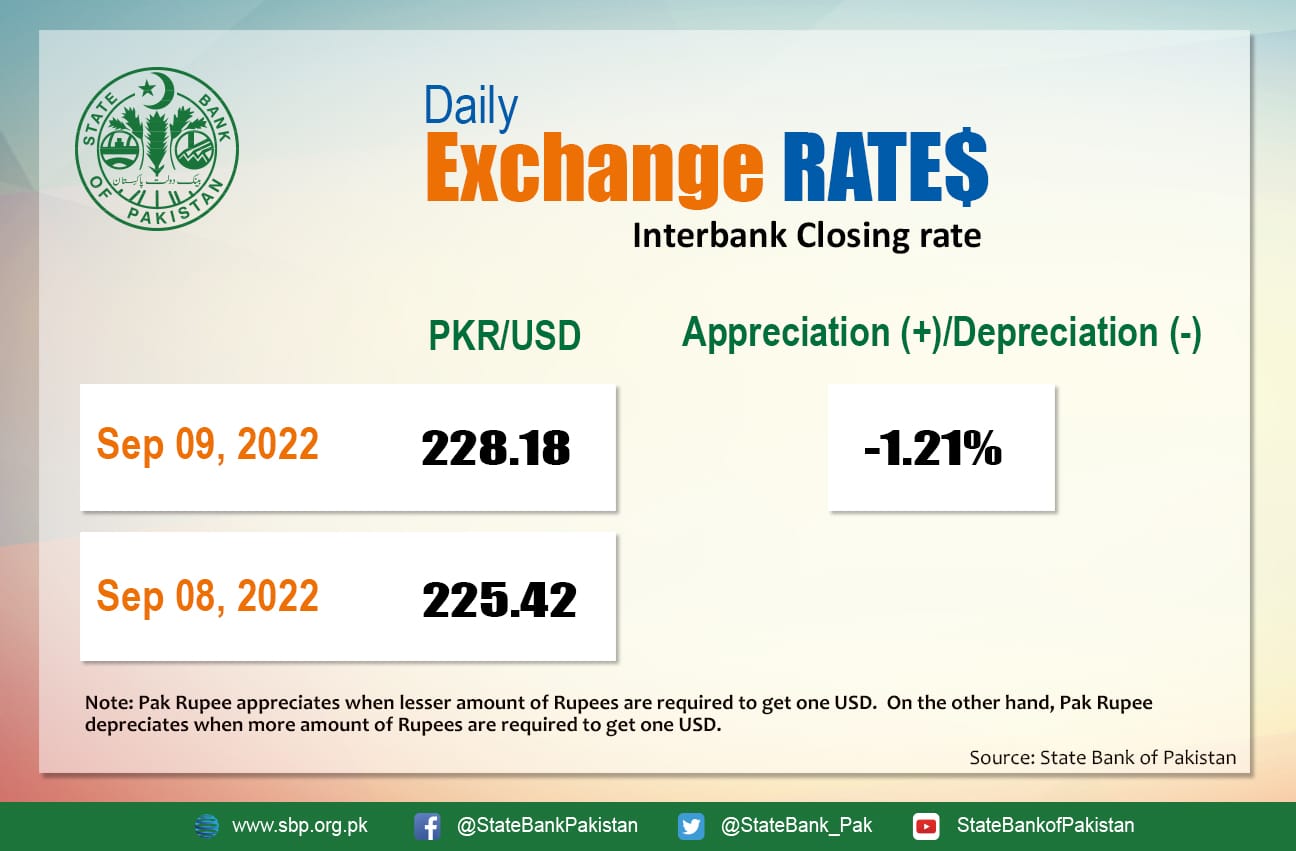

It depreciated by 1.21 percent against the USD and closed at Rs. 228.18 after losing Rs. 2.76 in the interbank market today. The local unit quoted an intra-day low of Rs. 228.48 against the USD during today’s open market session.

The local unit was bearish in the morning against the greenback and opened trade at 223 at around 10 AM. By midday, the greenback went as low as 228.125 against the rupee. After 2 PM, the local unit dropped to the 228-229 level against the top foreign currency before the interbank close.

The rupee closed in red against the dollar today sixth day in a row despite news from the State Bank of Pakistan (SBP) that it had received $1.1 billion from the International Monetary Fund (IMF) under the lender’s extended bailout program for the cash-strapped nation.

Analysts suggest the local unit’s decline can be attributed to the surging import bill, which has been increasing as demand for a variety of goods, including food, has soared after floods drowned one-third of the country.

Money changers expect the PKR to moderate once foreign assistance in the form of flood relief and direct investments from partner countries start flowing into the central bank reserves. Naturally, the effect of newer inflows is expected to be shortlived, unless the greenback peaks and falls down against other global indicators as well.

Globally, oil prices surged on Friday amid reports of real and threatened cuts to global supply, although crude was set for a second weekly decline as harsh interest rate hikes and China’s COVID-19 protocols dented the demand outlook.

Brent crude was up by 1.67 percent at $90.64 per barrel, while the US West Texas Intermediate (WTI) went up by 1.50 percent to settle at $84.79 per barrel.

Prices were supported by Russian President Vladimir Putin’s threat to halt the country’s oil and gas exports if European buyers imposed price caps.

Brent is down significantly from a rally in March close to its all-time high of $147 after Russia launched its operation on Ukraine. Despite today’s marginal reversal, both benchmarks looked like they were headed for a weekly drop of more than 2 percent, with Brent this week hitting its lowest since the beginning of 2022.

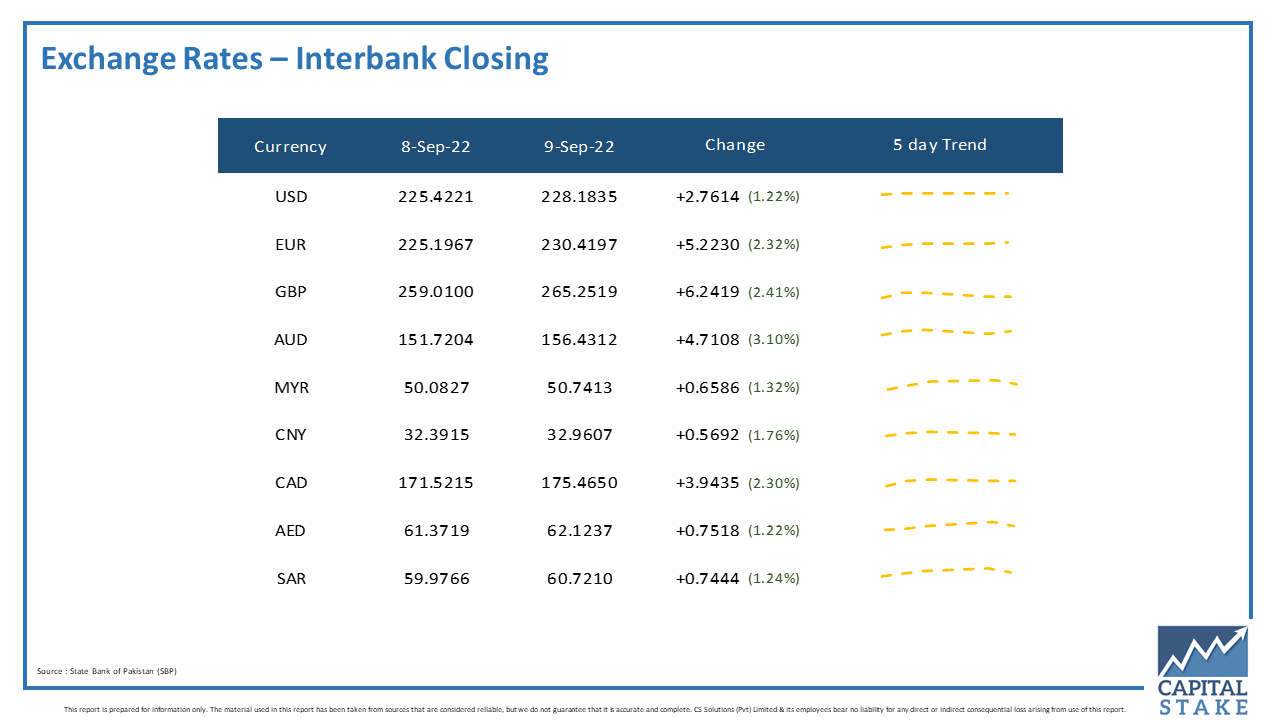

The PKR crashed against the other major currencies in the interbank market today. It lost 74 paisas against the Saudi Riyal (SAR), 75 paisas against the UAE Dirham (AED), Rs. 3.94 against the Canadian Dollar (CAD), Rs. 5.22 against the Euro (EUR), and Rs. 6.24 against the Pound Sterling (GBP).

Moreover, it lost Rs. 4.71 against the Australian Dollar (AUD) in today’s interbank currency market.